If you tell someone you’re learning how to build credit as a college student, you may be treated to the cliché, “If you can’t afford it, don’t get it.” Unfortunately, that’s not realistic — even renting an apartment requires good credit!

But you may already know that. After all, the average graduate student age is 33, so you may have been in “the real world” for a while. But building credit as a graduate student, even in one of the most affordable master’s programs, can be challenging. We’re here to help you figure out how to build credit as a college student. In this piece, some big questions will be answered, such as:

- How can I read my credit score and know if it’s good?

- Where do credit scores come from, and how are they calculated?

- How can I help my score increase?

- Can I build credit while in graduate school?

Read on to learn more about credit scores and how to build your credit while in graduate school.

How Can I Tell if I Have a Good Credit Score?

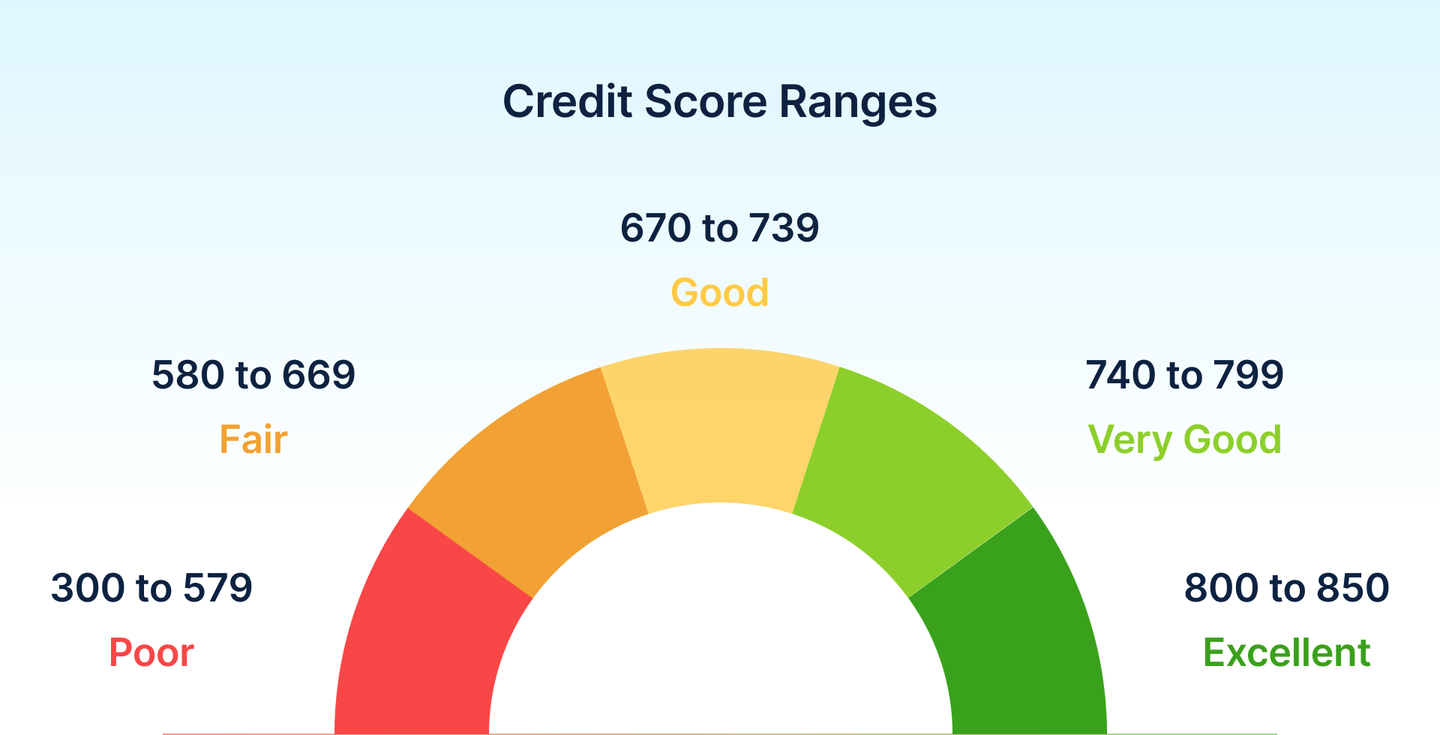

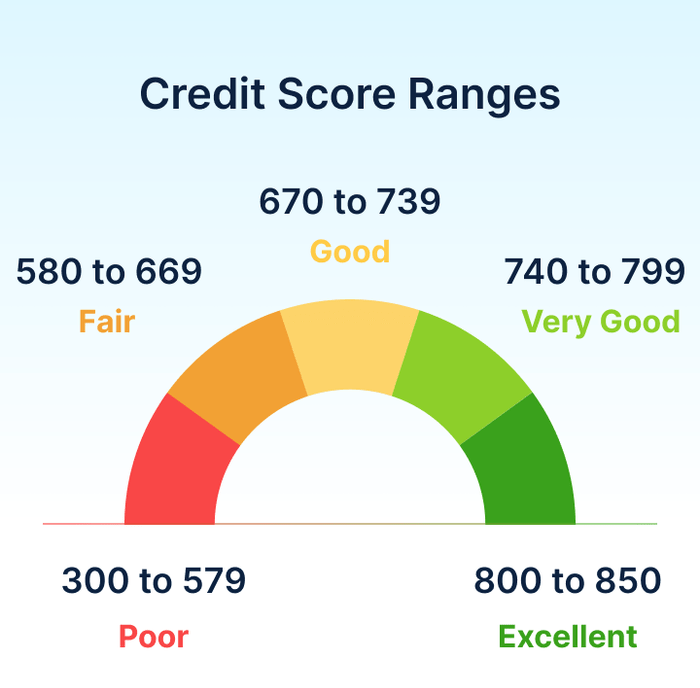

Your credit score ranges between 300 and 850 and is divided into five categories ranging from “Poor” to “Excellent.” Of course, many factors contribute to defining each label. Knowing how to read your score can help you figure out how to build credit as a college student in a realistic way.

Before diving in, you should know that there are two major credit score algorithms: FICO and VantageScore. We’ll be focusing on FICO, as that’s what 90% of lenders in 2024 use to determine creditworthiness. As always, keep an eye out for changes to the financial landscape. Below, we offer a snapshot of the range of credit scores held by Americans illustrated in the graphic.

800 to 850: Excellent Credit

As of late 2023, about 22% of consumers have an “Excellent” FICO score. They’ve made on-time payments on loans and credit cards for years and have little debt. People at this level often have no problem getting their ideal credit card or loan.

740 to 799: Very Good Credit

About 28% of consumers have “Very Good” credit. They often have a bit more debt or a short credit history but qualify for an outstanding loan or credit card.

670 to 739: Good Credit

Nearly 22% of people have “Good” credit and are doing well overall. They may qualify for loans and cards with decent terms, rates, and amounts.

580 to 669: Fair Credit

Roughly 16% of consumers fall into this category. Lenders may require a cosigner, and credit cards generally have high interest or low limits.

300 to 579: Poor Credit

About 13% of consumers have “Poor” credit. They’re in debt and behind on payments (or were recently). Getting a loan or credit card is difficult but not impossible.

How Are Credit Scores Calculated?

Knowing where your credit score is coming from can help you figure out how to build credit as a college student. It all starts with your FICO number. FICO is a scoring method used by Experian, Equifax, and Transunion — known as the big three credit reporting bureaus. Your credit score is based on five categories:

Payment History (35%)

Payment history affects your credit score the most because it reflects whether you pay your debts on time. Late card or loan payments stay on your report for seven years. However, the negative effect of a single incident will become less impactful over time.

Amounts Owed (30%)

The amounts owed category considers five factors:

- Total amount owed: The amount of all debts combined.

- Amount owed on different account types: Installment loan and credit card debts’ respective balances.

- Number of accounts with balances: How many accounts you have with a balance owed; you don’t want zero, but you also don’t want too many.

- Credit utilization ratio: How much money you owe toward credit cards compared to how much you could spend. Typically, you want to keep this below 30%; so, you’d want to keep a $10,000 credit card at or below (roughly) $3,300 balance owed.

- Installment loan amounts balance vs. amount owed: The amount you still have to pay on an existing installment loan.

Length of Credit History (15%)

Length of credit history looks at the average age of all types of open credit accounts, the newest and oldest accounts, and the ages of specific accounts. Because longer is better, closing your oldest credit card (even if you no longer use it) is usually not advisable. Installment loans naturally fall off, and as a result, repaid loans can lower your score in part because they no longer factor into your credit history’s average length.

This is especially true when it comes to college students and credit history, as an acceptable credit history can take up to 10 years to build. Many people don’t begin their credit experience until they’re at least 18.

New Credit (10%)

New credit refers to how recently you took out loans, opened credit accounts, or had your credit run. The less new credit you have, the better.

Credit Mix (10%)

Credit mix is the variety of accounts appearing on your credit report. Ideally, you’ll want a mix of installment accounts (like a loan, with set payments and a required end date) and revolving credit (like credit cards, with no required final payoff date and more flexibility in how much you pay each month).

Credit Scores & Student Loans: Common Questions

Your ability to qualify for graduate student loans, even those administered federally, may be impacted by your credit score. Additionally, your loans can affect your credit score. But what does that mean for you? Here are some common questions grad students have about how student loans and their credit scores are intertwined.

1. Can I get a graduate student loan with average or poor credit?

People with average, nonexistent, or poor credit might qualify for student loans for grad school.

If you are eligible for Direct Subsidized or Unsubsidized Loans through the U.S. Department of Education, you can apply for those regardless of your credit score. However, when you apply for a Direct PLUS Loan, your credit is run, and you could be denied if you have an adverse credit history. An alternative path is to find a lender (such as a bank) that offers student loans to those with poor credit. The terms and rates may be worse than for someone with excellent credit, though.

2. How will getting a graduate student loan impact my credit score?

Graduate student loans affect your credit score because they are debts. Plus, your credit score is run for federal and private options, meaning you’ll accrue additional hits to your credit score.

However, making timely payments and not allowing interest to accrue on your student loans can mitigate damage to your score — and serve to improve it in the long run.

3. How will an existing undergraduate loan affect my chances of getting a graduate student loan?

Undergraduate student loans affect your grad student loan chances based on how much you owe vs. how much you took out and whether you’ve made your payments on time and in full. High debt or missed payments can hurt your chances of getting a good graduate school loan. But reliably paying and lowering the debt can help.

4. Do grad student loans accrue interest or have to be paid while I’m in school?

There are many steps along a typical graduate student loan timeline; one of the most important is the step involving payback of student loans, which most financial experts recommend should happen while you’re in school. However, some loans, includingfederal Direct Subsidized Loans, offer deferment of payment and interest while you’re attending school.

Unlike subsidized loans, Direct Unsubsidized and PLUS Loans accrue interest from day one. And even though payments aren’t required, once again, making payments during this time is advisable so you don’t graduate with additional debt from the interest.

Private student loans generally also accrue interest while you’re in school. Some lenders require regular monthly payments while you’re in school, while others may offer interest-only or very low monthly payments until you graduate. A few even require no payments while you’re in school — though they likely still charge interest. Students who are offered low or no payments during school usually need a good credit score or a cosigner.

5. What financial options do grad students have if their credit is low?

Even if you have a poor credit score, you’ll find many ways available to help you pay for your master’s program.

The first options to consider: Free money via graduate school scholarships and grants. You might even be eligible for graduate school fellowships. Scholarships and grants sometimes factor in financial need, while fellowships are more focused on academic merit. Also check into assistantships, which typically involve working with a professor to ensure their classes run smoothly and efficiently or supporting them in their research.

While working in addition to taking classes toward a master’s degree can be challenging, it may be a good idea: Paying for as much of your education out of pocket as possible means less debt when you graduate. In some cases, going to an online graduate program may make your school/work/life balance a little more manageable.

And of course, if your workplace offers tuition reimbursement or assistance as a benefit, make sure you’re taking advantage of it to the fullest.

If you’ve exhausted these options and still need a loan, research your federal and private options to see if you can qualify for reasonable terms and interest rates with your credit score. If you strike out, see if you can find a cosigner — someone with good credit who promises they’ll make payments if you don’t — to improve your chances. (Tip: Make sure the cosigner knows what they’re getting into, as cosigning will impact their credit score.)

Tips for Grad Students to Build (or Improve) Their Credit

If you’re trying to decide how to build credit as a college student, you have a lot of specific actions you can take during your master’s program.

Credit Mistakes to Avoid

You’ve already learned many tips that will help you build your credit, so now it’s time to look at the actions to avoid in order to bolster your credit health.

Using Credit Cards Responsibly

Using a credit card responsibly can improve your credit score or help you build credit for the first time. If you’ve never had a credit card, you may want to consider getting one to improve your credit mix. But if your score is already in terrible shape, opening additional accounts is not recommended.

If you already have a credit card, use it very sparingly — if at all. Your credit score does not benefit when you carry a balance. And it’s perfectly acceptable to not use your credit card every month, and in fact, keeping the account open even if you’re not using it can help your credit score by lengthening your credit history.

A credit card with a promotional 0% APR can be a massive help if you have a sudden expense. While the new debt can ding your score, paying it off before the promo period ends gives you a better debt-to-borrowing limit ratio — and means you didn’t pay a dime of interest on your purchase.

If you already have a credit card and need a higher borrowing limit or lower interest rate, you might be able to negotiate with your servicer. Credit card companies are often open to negotiation if you call and ask for a supervisor.

Resources

- How to Begin Your Financial Aid Journey

Learn practical ways to take advantage of financial aid during your master’s study. - Consumer Financial Protection Bureau – Credit Reports and Scores

The CFPB is a one-stop shop for all things related to understanding your credit score. You’ll also find links to resources, learn more about the factors that impact scores, and understand your rights as a borrower. - Equifax

At Equifax’s website, you can monitor your credit score and access resources related to credit. - Experian

Another of the three credit reporting agencies, Experian also allows you to monitor your credit score, learn ways to improve it, and discover fraud protection tactics. - Federal Student Aid

Here, you can dive into details about federal student loans — considerations, types, reasons for taking out loans, and more. - NerdWallet

NerdWallet covers a variety of finance topics with the average reader in mind. You’ll also find abundant credit-improvement recommendations at this site. - r/CRedit and r/StudentLoans

Subreddits like these allow people to ask and answer questions about credit and school loans. However, because anyone can use Reddit, consider responses to be jumping-off points for further research rather than final answers. - Smart Money Podcast

On this NerdWallet podcast, you’ll learn about two quick credit score tips and how to create a budget when you’re paid monthly. - TransUnion

The final in the list of big three credit bureaus, you can monitor your TransUnion score and find helpful resources on this site. - Udemy – Finance Courses

Online learning platform Udemy has a variety of personal finance courses, including some focusing on credit scores and improving your financial situation.

Expert Insight from a Credit Consultant

Jeanne Kelly is an author, speaker, and coach who helps people understand credit reporting, achieve higher credit scores, and combat identity theft. She is the founder of The Kelly Group and the author of the books The 90-Day Credit Challenge and The Credit Makeover. Jeanne Kelly is a nationally recognized authority on credit consulting and credit scores.

Many master's candidates don't work full-time while in school. How can they protect or build their credit when their income isn't steady?

When building credit while in school, you can apply for student cards. Use these like you would a debit card — only charge what you can afford to pay at the end of the month. Think of these credit cards as tools for investing in your future credit. Do not use them to get into debt, but to build a good score.

What is the biggest misunderstanding or misconception students have about credit scores?

The biggest misunderstanding is that credit is bad. The goal is to show responsible usage and repayment.

While every situation is different, what is the "easiest" action most grad students can take to help their scores improve?

Pay every bill on time and lower any credit card debt.

Knowing that grad students often can't afford to have a financial advisor, what are some resources they can use to help them figure out how to build or improve their credit scores?

The website annualcreditreport.com can let you check your credit for free. I also offer a free credit snapshot and grade. Some Universities do offer free financial workshops.

In your experience, how accurate are credit card statements, resources like CreditKarma, or individual credit bureaus' regarding up-to-date credit score estimates?

Credit scores give you an idea of where you stand but the ones you receive for free are often calculated using different models than what lenders see. 90% of lenders use your FICO scores.

Is "good debt" — typically referring to mortgages and federal student loans — real? Or does the FICO algorithm count all types of loans equally?

30% of your FICO score is based on balances but credit card debt is heavily used for this part of the score. So, your loans are still calculated, but not weighed as much as credit cards.